Companies like Berkshire Hathaway are market legends, consistently outpacing the competition.

However, Berkshire wasn’t always the big conglomerate it is today.

Through decades of keen investment strategies, Warren Buffett turned the company into a colossal empire, boasting a staggering 20% compound annual growth rate since 1965, leaving the broader market in the dust.

Since Berkshire Hathaway went public, its stock price has increased by approximately 2,159,614%. Enough to turn every £1,000 invested into well over £21,000,000.

Berkshire Hathaway would be considered an investment issuer, a company that primarily invests in other companies rather than directly engaging in manufacturing, production, or service provision.

This showcases the might of strategic acquisitions and diversified holdings, setting the gold standard for today’s market players.

Imagine if you could have invested in Berkshire Hathaway before it became a market titan.

What if we told you there’s a UK stock poised to follow in those legendary footsteps?

Meet Evrima (London AQSE: EVA), the rising star that’s turning heads.

According to analysts, Evrima’s share price is currently trading at well below its true value and its upside could yield short-term gains in excess of 500% for investors.

Think of companies like Evrima (AQSE: EVA) as modern-day versions of Warren Buffett’s early Berkshire Hathaway. Evrima’s investment philosophy mirrors Buffett’s winning strategy. They’re all about spotting and seizing growth opportunities.

Investing in Evrima means backing a company with a knack for identifying and nurturing high-growth opportunities. It’s a play straight out of Buffett’s book – finding value, fostering growth, and reaping the rewards.

Evrima’s Winning Investments

Evrima (London AQSE: EVA)boasts three significant investments in its growing portfolio:

1. Premium Nickel Resources Corporation

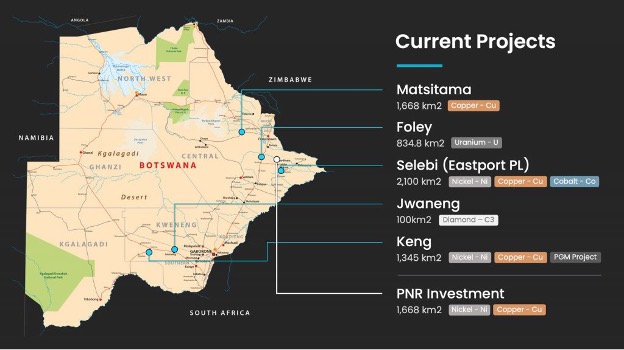

- Assets: Nickel, copper, and cobalt assets in Botswana, Greenland, Canada, and Morocco.

- Flagship Project: The Selebi Mine in Botswana encompasses an area of 11,504 hectares and extensive infrastructure, including two shafts and necessary utilities.

Evrima’s investment in PNRL is a treasure trove waiting to be unlocked, as the Selebi Mine has a rich history and significant potential. After acquiring the mine in January 2022, PNRL has focused on modernizing operations, enhancing resource evaluation through advanced drilling and testing, and exploring alternative, environmentally friendly metallurgical processes. This strategic approach aims to revitalize the mine and ensures a sustainable, long-term supply of critical metals.

PNRL’s vision aligns perfectly with Evrima’s investment philosophy. By focusing on the redevelopment of the Selebi Mine, PNRL is set to contribute significantly to the global electrification industry. The company will supply essential metals such as nickel, copper, and cobalt, which are crucial for producing electric vehicles, renewable energy systems, and advanced batteries needed for the world’s new energy and electrification demands.

Their commitment to best practices in safety and environmental sustainability makes this investment a cornerstone of Evrima’s growing portfolio, showcasing its ability to back innovative, future-focused enterprises.

2. Eastport Ventures Inc.

Eastport Ventures is a Canadian mining house renowned for its seasoned explorers and corporate investors. With a strategic focus on Botswana, Eastport is dedicated to discovering and maximizing value from its extensive asset base.

Their robust project portfolio targets high-demand minerals like copper, nickel, uranium, and diamonds.

Evrima’s investment in Eastport Ventures is a testament to its keen eye for companies with substantial growth potential. Eastport’s methodical construction of a diversified exploration portfolio and strategic investments in Botswana aligns perfectly with Evrima’s philosophy.

3. Kalahari Key Mineral Exploration

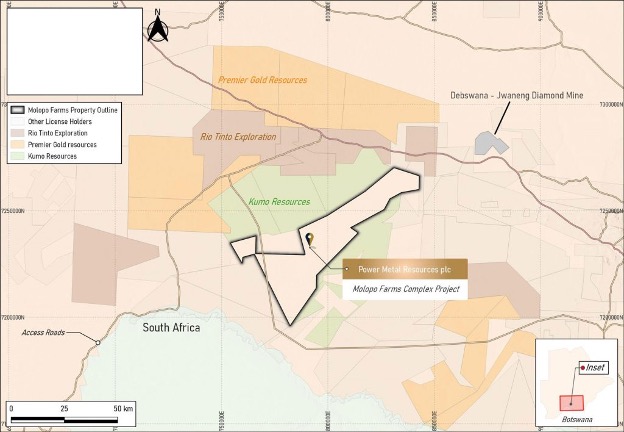

- Project: Molopo Farms Complex (MFC), focusing on Nickel-Copper-Platinum Group Metals (Ni-Cu-PGM).

Kalahari Key is a private exploration company based in Botswana that is driving forward the Molopo Farms Complex, a promising Ni-Cu-PGM project

The Molopo Farms Complex, spanning 1,723 km², targets rich Ni-Cu-PGM mineralization along the major ENE-WSW Jwaneng-Makopong Shear/Feeder Zone, promising substantial returns.

Evrima’s investment in Kalahari Key underscores its commitment to high-potential mining projects. By supporting the development of the MFC, Evrima taps into the lucrative Ni-Cu-PGM sector, poised for growth with the increasing global demand for these critical metals. This strategic move aligns with Evrima’s vision of backing innovative projects with significant upside potential.

Investing in Evrima (AQSE: EVA / ISIN: GB00BMDFKP05) means investing in highly potential investments at a fraction of their true value.

Once shares of Evrima start going up, it could shoot past 10 pence in the blink of an eye.

This is why right now could be the last chance investors get to buy shares of Evrima at just around 2 pence.